Loan Products

Submit Additional Documents

Simple. Convenient. Secure.

Please follow our directions below if you need to submit additional documents to our lending team.

Instructions:

Step 1:

Click our ‘Upload Supporting Documents’ button below to access our secure file submission portal.

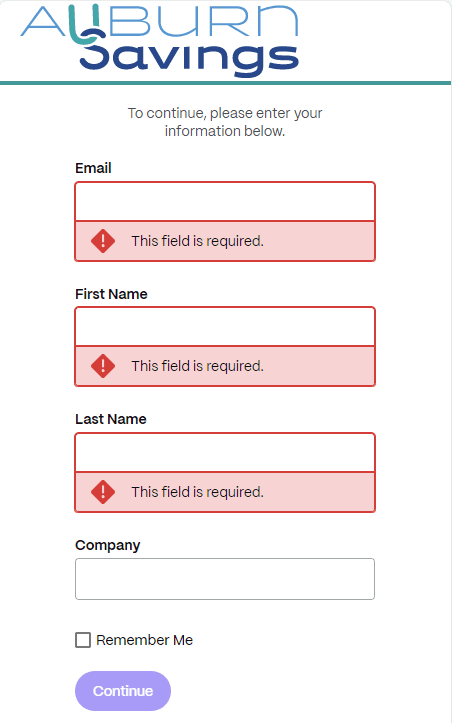

Step 2:

Fill out your name and contact information in the required fields, then press continue.

Step 3:

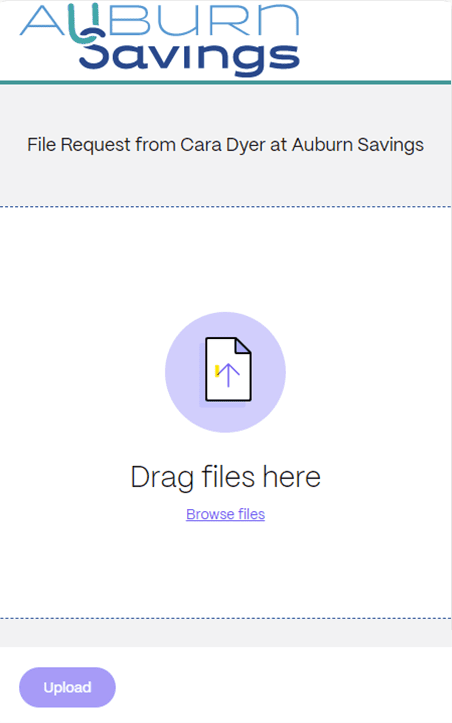

Lastly, on the File Request page, please drag your file(s) into the submission field or select which file(s) to submit from your device.

For more details about additional documents you may need to submit, please reference our tabs below.

Required Documents by Loan Type:

Mortgage, Construction, Home Equity

- Two Years most recent federal tax return, personal and business if applicable.

- Two Years W‐2 forms from all employers.

- Copies of Paystubs for a period of at least 30 days (4 if paid weekly, 2 if bi‐weekly, 1 if monthly).

- Two months most recent bank statements.

- Most recent retirement funds statement.

If applicable:

- Current Awards Letter for Social Security and/or Pension.

- Most recent mortgage statement, tax bill, and insurance bill, for all properties owned.

- Two years annual tax statement for social security and/or pension.

- Copy of Purchase and Sales Agreement/Bill of Sale.

- Copy of canceled Earnest Money Check.

Consumer (Auto, Recreational)

- Copies of Paystubs for a period of at least 30 days (4 if paid weekly, 2 if bi‐weekly, 1 if monthly).

If self-employed:

- Last Three Years Personal Tax Returns including schedules.

- Most Recent Interim Statement if application date is more than six months beyond fiscal year.

If applicable:

- Bill of Sale.

Commercial

- Last Three Year-End Business Financial Statements (tax returns or accountant-prepared statements).

- Last Three Years Personal Tax Returns including schedules for all Owners/Guarantors.

- Most Recent Interim Statement if application date is more than six months beyond fiscal year.

- Personal Financial Statement for all Owners/Guarantors.

- Business Debt Schedule – a list of all the debts your business currently owes, their current balance, original amount, monthly payments, and other pertinent details.

If applicable:

- Copy of purchase agreement.

- Current rent rolls.

- Copies of current leases.

- New business projections (rental income, revenue, etc).

Let’s get started!

Contact one of our Lending Specialists today to learn more.

|

Bob MichaudSenior Vice President & Senior Lender |

|

Cara DyerVice President & Loan Officer |